Tax Collector

Consetta Ellison, Tax Collector

Phone: (732) 446-8360

Fax: (732) 446-7998

Email: taxcollector@mtnj.org

TOWNSHIP OF MANALAPAN TAX COLLECTOR’S OFFICE

The Tax Collector’s Office is responsible for collecting Real Estate taxes for all properties in Manalapan Township. Taxes are due on the first of February, May, August and November. There is a 10 day grace period after which interest is applied, calculated at 8% on the first $1,500 past due and 18% for any amount over $1,500. (per NJSA 54:4-67). Properties with delinquent municipal charges (taxes, sewer and interest) totaling $10,000.00 or more at calendar year end are subject to an additional 6% year end penalty.

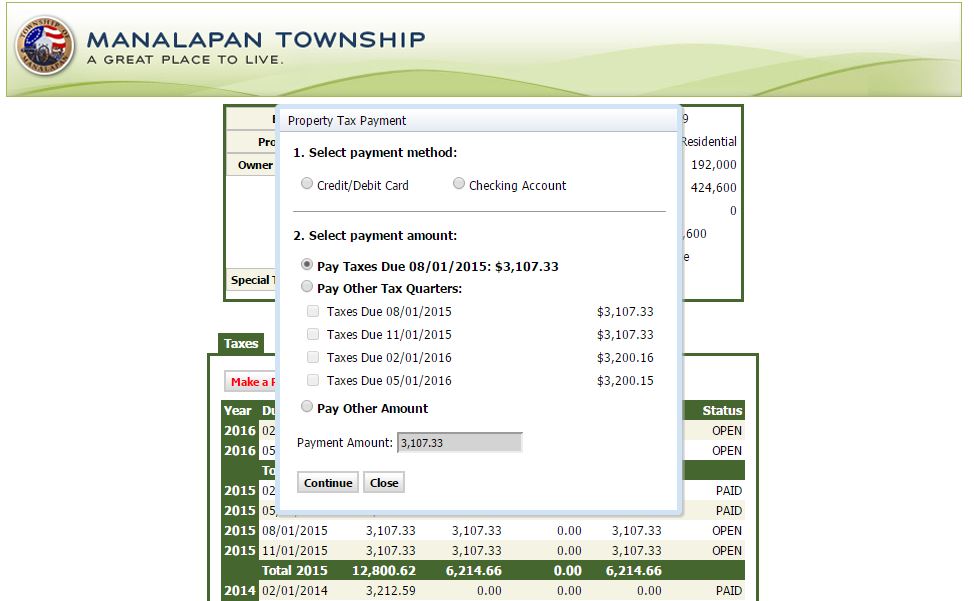

TAX PAYMENTS – Tax payments may be made by mail, online or in person. Payments can be made without a tax bill at the municipal building, however, if you require a receipt when paying in person, you must present the entire tax bill with your check. If you require a receipt by mail, send the entire tax bill with a self addressed, stamped envelope. Otherwise, you may simply present the stub with your check – the canceled check will be your receipt.

Tax payments may also be made by: 1) using your own banks online bill pay. Please use the Tax Account ID located on the front of your tax bill as the account number. 2) Credit Card, debit card or e-check on our website. The link is on the upper left hand side of this page. Please note there are fees associated with online payments. 3) Tax payment drop box located on the left wall outside of the municipal building. The drop box is under surveillance and available 24 hours, 7 days a week. Payments left in the drop box after 4:00 pm will be credited as of the next business day. The drop box is for checks only.

Payments must be received in our office on or before the tenth of February, May, August and November. If the tenth falls on a holiday or weekend, the grace period will be extended to the next business day. Payments received after 4:00 p.m. on the last day of the grace period will accrue interest charges calculated from the statutory due date. Postmarks are not accepted. Please note the Tax Collector is not responsible for delayed or lost mail.

PLEASE NOTE: THE TAX COLLECTOR’S DUTY IS TO COLLECT ALL TAXES DUE IN ACCORDANCE WITH STATE STATUTES. SHE HAS NO STATUTORY AUTHORITY TO REDUCE A TAX OR WAIVE INTEREST CHARGES.

CHECK LIST: There are often times when the tax collector must return checks that are written incorrectly. These errors cause delays and necessitate interest being charged on late payments. Please double check the following when filling out your check:

- Check is made payable to Manalapan Township

- Check has the current date; post dated checks cannot be accepted

- Check is signed

- The numeric amount matches the written amount

TAX BILLS – Tax bills are mailed once a year in July. New tax bills are not mailed when there is a change in ownership. If you sell your property, make a copy of the bill for your records and give the original bill to the new owner at closing. If you are a new owner and did not receive the bill at closing, please contact our office or click the link on the upper left hand side of this page to view and/or pay property taxes online or print a copy of your bill. Failure to receive a tax bill does not exempt the taxpayer from paying taxes or interest that may be due. Please read the front and back of your tax bill for important tax information.

On our website, you can also find your tax amount due, print a copy of your bill and calculate interest to a future date.

Taxes can be paid on-line via credit/debit card or e-check. Residents can also print a copy of the current year’s tax bill and calculate interest to a future date.

Click here for current tax balance information or to make a payment on-line

ANCHOR BENEFITS, SENIOR FREEZE AND STAY NJ ASSISTANCE: 1-888-238-1233

If you need help with filling out your PAS 1, the State of NJ has a walk-in Service available in Freehold. It is located in the Freehold Regional Information Center, Division of Taxation, 2 Paragon Way, Suite 1100 in Freehold from 8:30 am to 4:00 pm Monday through Friday.

https://www.nj.gov/treasury/taxation/relief.shtml

The Tax Collector’s Office maintains office hours – Monday – Friday, 8:30 a.m. – 4:00 p.m.

Please contact our office via Phone 732-446-8359, 8360, 0r 8363 Fax 732-446-7998

Email mbinaco@mtnj.org, dcochran@mtnj.org, or taxcollector@mtnj.org

EXTENDED HOURS – extended hours are available on the first Thursday evening of February, May, August and November, 8:30 a.m. to 7:00 p.m. to accommodate taxpayers who wish to pay their taxes in person and are unable to do so during regular working hours.

Tax Rates

The tax rate is determined by the budgets of the Township, County, Elementary School, High School and Fire Companies. Manalapan has two Fire Districts serving the community therefore there are two different tax rates.

The table below reflects the tax rates per $100 of assessed value.

| Taxing Authority | 2025 | 2024 | 2023 | 2022 | 2021 | 2020 |

| County Tax | 0.180 | 0.182 | 0.183 | 0.198 | 0.239 | .246 |

| County Library | 0.011 | 0.013 | 0.013 | 0.015 | 0.018 | .018 |

| Regional Elementary School | 0.769 | 0.780 | 0.761 | 0.826 | 0.948 | .945 |

| Regional High School | 0.372 | 0.347 | 0.339 | 0.358 | 0.427 | .416 |

| Municipal Tax | 0.266 | 0.279 | 0.285 | 0.307 | 0.351 | .334 |

| Municipal Open Space | 0.020 | 0.020 | 0.020 | 0.020 | 0.020 | .020 |

| County Open Space | 0.027 | 0.027 | 0.026 | 0.026 | 0.290 | .029 |

| Total General Tax Rate | 1.645 | 1.648 | 1.627 | 1.750 | 2.032 | 2.008 |

| Fire District 1 | 0.038 | 0.040 | 0.037 | 0.038 | 0.044 | .045 |

| Fire District 2 | 0.035 | 0.040 | 0.036 | 0.042 | 0.050 | .052 |

| Total Tax Rate Including Fire District #1 | 1.683 |

| Total Tax Rate Including Fire District #2 | 1.680 |